S&P 500 bears proved they hold shorter end of the stick, just like I warned early in the European session yesterday, and my aftermarket conclusions confirmed that. It‘s that bonds turned really risk-on on a daily basis, and market breadth very much improved, which means that this rally can and will go on to challenge 4,115 – and not even a hotter (above 0.4%) core PCE figure tomorrow would derail it.

Even if unemployment claims aren‘t yet surging sharply, recession is approaching. It‘s the tight (ened) bank lending standards, reprieve in real eastate based on mortgage rates retreat (helping with consumer confidence and retail sales as there are still some excess savings to burn through) about to end, and the improving 10 over 2y yield spread, that are signalling approaching recession while LEIs continue declining.

Russell 2000 could have been stronger really yesterday, and several big tech names (incl TSLA which isn‘t though classified as tech) are slowly struggling (this is medium-term view only) as much as crypto has some bearish divergences in the making.

Keep enjoying the lively Twitter feed via keeping my tab open at all times – on top of getting the key daily analytics right into your mailbox. Combine with Telegram that never misses sending you notification whenever I tweet anything substantial, but the analyses (whether short or long format, depending on market action) over email are the bedrock. So, make sure you‘re signed up for the free newsletter and that you have my Twitter profile open in a separate tab with notifications on so as to benefit from extra intraday calls.

Let‘s move right into the charts.

S&P 500 and Nasdaq outlook

The buyers won‘t give up today either, and 4,039 shouldn‘t come into jeopardy in the least (4,015 if the going gets really tough, which it won‘t till tomorrow‘s core PCE). The bulls will likely deal with existing minor non-confirmations while not creating fresh ones today. 4,115 target approaching.

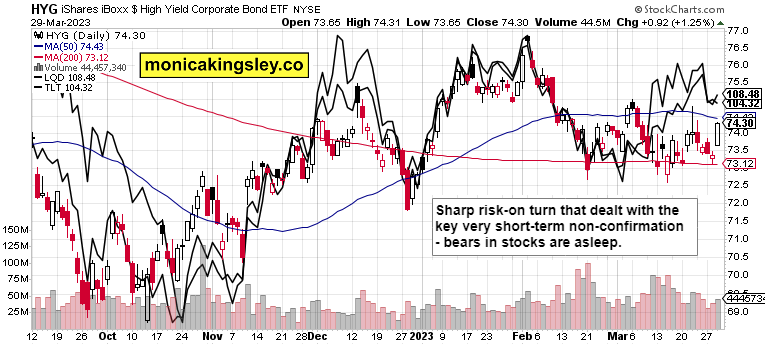

Credit markets

Bonds aren‘t to turn risk-off today, and would pose no obstacle to the stock market bulls. What‘s interesting though, is the short end of the curve, and the evolution of bets on the Fed tightening to not only be over soon, but to turn into rate cuts (seeing an emergency one in Jun or so, is though terribly misguided in my view).

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.